Welfare for the wealthy

Half of all business meal expenses are tax deductible. This puts SNAP cuts in helpful perspective.

(Illustration by Olena Koliesnik / iStock / Getty)

I’ve noticed that whenever I write about privilege—advantages that have nothing to do with what I deserve or how hard I work—conservative critics let me have it. They’re ready to challenge any hint of a suggestion that their own economic status, religion, skin color, or educational background might confer similar unearned advantages on their lives. Preferring to believe that everyone exits the womb with equal opportunity, they dismiss the idea that tailwinds power large segments of their life while persistent headwinds thwart the advancement of other lives.

Once we confuse the benefits accompanying our unearned privilege with what we’re certain we deserve, it becomes easy to look down on others who struggle. We revert to a playbook that disparages the poor for being poor. We assume that income support to the needy generates indigence, that government funding of food and nutrition programs incentivizes laziness and creates a culture of dependency. Misleading stereotypes about the poor quickly lead to their harassment.

Read our latest issue or browse back issues.

Many states require drug testing as a condition for receiving government benefits, even though welfare recipients are statistically no more likely to use drugs than the rest of the population. The Iowa legislature recently showed its disdain for the hungry by imposing the nation’s harshest restrictions on eligibility for the Supplemental Nutrition Assistance Program, a particularly cruel move in light of the state’s $1.91 billion budget surplus last year. These kinds of aggressive actions against people who receive public assistance point to willful blindness, arrogance, or meanness—maybe all three—on the part of those who live with enough.

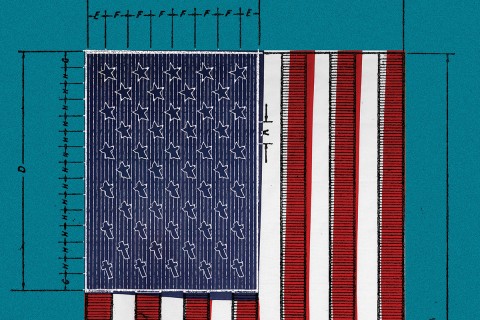

I have a friend who believes the poor feel entitled to welfare. I have yet to hear him suggest that the rich feel entitled to tax breaks and write-offs. The bulk of government handouts in the United States actually go to those above the poverty line, disproportionately benefiting the rich. Indirect subsidies and tax rebates are certainly not as visible to the public eye as food stamps and welfare checks. Suzanne Mettler of Cornell University describes the hidden nature of these benefits in her book The Submerged State. Conservatives relentlessly promote tax breaks, often channeling them through private delivery mechanisms in order to mask the government’s intervention on their behalf. Despite the appearance of governmental spending restraint, these vast outlays represent massive subsidy payments. Though billed as tax breaks instead of social programs, they are targeted government spending: they single out people in special circumstances and offer them extra financial assistance.

Current tax law allows companies to deduct half of all business meal expenses, a government commitment that puts its spending on food stamps in helpful perspective. Landlords can deduct most expenses associated with renting property, from mortgage interest to repairs. Long-term capital gains are taxed at substantially lower rates than ordinary income. Social Security taxes are not levied beyond a certain income limit. The home mortgage interest deduction is among the largest federal tax expenditures, and it benefits mostly higher-income households.

Even the Congressional Budget Office identifies these deductions as direct financial assistance from the government. As long as we’re talking welfare for the rich, we might as well include grants, loan guarantees, price supports, and farm subsidies. By the way, nobody has to take a drug test for any of this government assistance.

Maybe hostility toward the poor derives from the crooked notion that wealth is virtue and virtue is wealth—or from the fanciful idea that everything we enjoy in life is earned or deserved. Whatever the case, until we clear our minds of such foolishness, we’re apt to keep looking conveniently past all kinds of handouts and privileges that benefit our lives.